So you’re one of the lucky 2/3 of Americans who own a home and no longer have to pay rent. That’s great, but by no means is home ownership cheap. With the rising costs of living, finding ways to save money is something that everyone should do.

Here are 17 things to do immediately that will reduce the maintenance costs of your home over the long haul. You can read about them and click any of the links provided for more information.

1. Check The Insulation in Your Attic – And Install More If Needed.

If you have an unfinished attic, pop your head up there and take a look around. You should see insulation up there between the beams, and there should be at least six inches of it everywhere (more if you live in the northern part of the United States).

If there’s inadequate insulation up there – or the insulation you have appears to be damaged – install new insulation. Here’s a great guide from the Department of Energy on attic insulation, including specifics on how much you should have depending on where you live. Many states offer financial incentives, up to a 75% refund for instance, to encourage homeowners to better insulate their homes.

2. Don’t Pay For Another Costly Home Repair Out Of Pocket Again

It’s always a disruption when appliances like ACs or washing machines break down. Worse yet, most of us can’t afford to go out and replace or repair them on the spot, yet are forced to, since they are rarely covered by home insurance policies. They always seem to break down when we need them most, but next time, you don’t need to pay out of pocket for anything…

Clever homeowners are using this new Choice Home Warranty, and are saving thousands in the long run by protecting themselves against unexpected home repairs. All appliances you can think of are covered entirely by this program, and in many cases, they’ll completely replace your appliance with a brand new one. Without paying a penny out of pocket or unexpectedly, you can save yourself the financial impact and inconvenience of future break downs.

Enter ZIP to Check Eligibility Here

How Do I Qualify?

Step 1: Click how long you’ve lived in your home to instantly check your eligibility for free

Step 2: View your instant free quote and save!

Click here to get your free quote

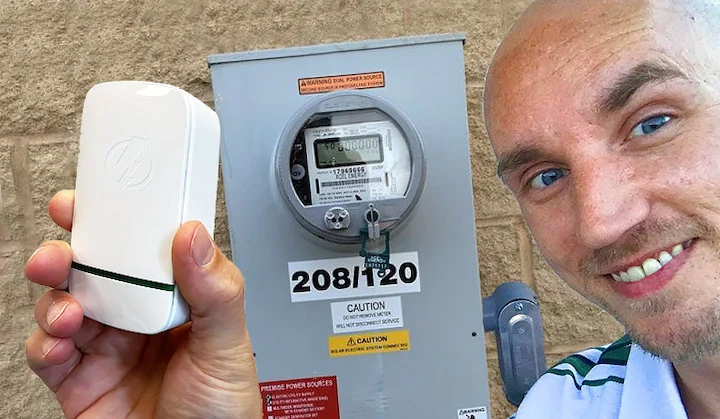

3. Breakthrough Device That Could Cut Power Bill By Up To 90%

It’s no secret that the price of electricity is rapidly rising this year, but thanks to this new Nikola-Tesla-inspired technology, consumers can save hundreds to thousands of dollars every year on their electric bills.

Simply plug the device into any wall outlet, and it begins to re-amp your home’s electric currents. The result is more efficient power distribution and usage, that you benefit from in the form of lower power meter readings.

4. Lower The Temperature on Your Water Heater Down To 120 Degrees Fahrenheit (55 Degrees Celsius)

This is the optimum temperature for your water heater. Most people don’t use water hotter than 120 degrees — indeed, water hotter than that can scald you or a child — and thus the energy needed to keep the water above 120 degrees isn’t used effectively. Lower the temperature, save money on your energy bill, and you’ll never skip a beat.

5. Most Homeowners Get a Big Car Insurance Discount. Make Sure You Claim Yours.

Homeowners typically get big discounts on car insurance. But here’s the rub – your car insurance company won’t tell you this.

What you need to do is use this free online tool to compare insurance company discounts side by side. Then you’ll see just how much you can save.

This is the internet’s leading free consumer comparison website, where you can compare rates from name-brand companies. Better still, they’ll show you the discounts you are missing. Most users can save up to $600/yr. Not bad for a few clicks.

Give their free service a try – it takes all of two minutes, and like we mentioned, can put up to $600 back in your pocket.

6. Never Pay For A Monthly Security Alarm System… Get This Instead

Did you know that homes without security systems are 2.5 times more likely to be targeted by burglars and intruders? But installing a home alarm system can mean monthly fees that never end. So instead of spending hundreds or thousands of dollars on a home security system – get these easy to install PixieLens Pro cameras and place them all around your house!

This discreet camera is designed to look like an ordinary lens, allowing you to discreetly record video and audio without anyone knowing.

Plus, its compact size makes it easy to take with you wherever you go. You can get a live view of your home at any time just by opening up the app on your smartphone. These only cost $39.99 each so you’ll save a ton of money instead of paying huge amounts every month for an alarm system.

7. Homeowners In Eligible Zip Codes Can Save Up To $1,632/yr On Their Home Insurance. Check If Your Area Qualifies…

One of the quickest ways to save money as a homeowner is to lower your insurance rates. By using Home Quotes Zone, you can compare multiple insurance quotes in just minutes. This easy-to-use website helps you find the best deals tailored to your needs, ensuring you get the most coverage at the lowest price. Don’t miss out on potential savings—visit Home Quotes Zone today and see how much you can save on your home insurance!

8. Buy Non-Perishables in Bulk and Use Coupons

Many people never even bother to look at some of the larger packages of nonperishable items – they think it’s just too much. Try looking at the cost per unit of all of the sizes and choose the one that’s the best deal. Check for coupons and coupon codes for items you go through a lot of. There are many coupon sites out there with updated daily deals on hundreds of items. Simply search for what you need (and don’t buy what you don’t need, even if it’s on sale!) and if a good enough coupon presents itself, buy it in bulk.

Spread out over months and over a lot of items (think of all of the nonperishables in your home, from salt and sugar to soap and shampoo – food is just the beginning), this can add up to a lot of trimmed wallet fat.

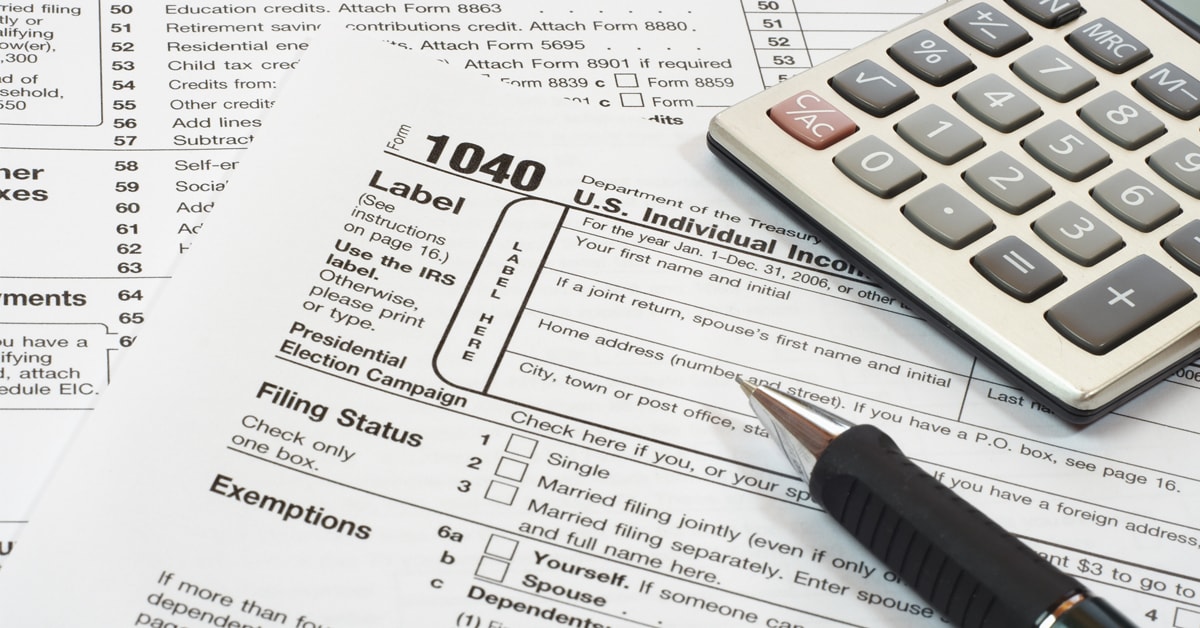

9. Deduct Your Mortgage Interest On Your Tax Return

A report from Congress’ Joint Committee on Taxation estimates some $70 billion in mortgage interest deductions annually among American taxpayers. Make sure you get your fair share — not just because mortgage interest can be substantial, but this tax break alone opens the door for many taxpayers to itemize other, smaller breaks instead of settling for the standard deduction. Simply use Form 1098 if you have paid more than $600 in mortgage interest in the tax year.

10. Get A Personal Loan (From $100 to $35,000)

Many homeowners might find that they are unexpectedly in a tough financial spot and need a little bit of help. That’s where personal loans can help. Personal loans can be used for almost any expense – from paying off credit cards to financing home repairs. They are typically paid back in monthly or bi-monthly installments over an extended period of time. Personal loans can be a convenient alternative to bank loans or high-interest credit cards, with online applications and no-hassle automated repayment. With AmOne you get access to loans for whatever you need and get to see the terms upfront before any commitment. Make sure you look at the interest rates offered and the loan repayment terms before going ahead with anything though.

11. Save Money on New Windows

Many people opt to replace old drafty windows at home with new energy-efficient ones. Replacing old windows can also lower your utility bill by 40% per month and increase your home’s curb appeal. You may also qualify to save $100s in seasonal discounts from manufacturers like Pella, Champion, and Andersen. Make sure you find the best price you can get by shopping around to compare pricing from local professionals.

12. Replace Your Bulbs With Surge Emergency LED’s

If you’ve never updated the lightbulbs in your home, consider switching to blackout proof LEDs. These bulbs are about four times more energy efficient than incandescent bulbs and last for many years. One tip: When comparing bulbs, use the lumens number to compare bulbs, not the equivalent wattages. Lumens indicate the actual amount of light emitted by the bulb.

Remember also that under normal usage (four hours a day) and average electrical rates ($0.12 per kilowatt hour), replacing a 60-watt bulb with a 14-watt LED saves about $0.66 per month. Now multiply that by all the bulbs in your house to see how much you’ll save every month. Even switching just the five most-used light bulbs in your home could save you upwards of $40 a year on your electric bill.

13. Cut The Cord on Cable & Streaming Services Forever

Millions of Americans are completely cutting the cord on their monthly cable costs, allowing them to save $100+ per month in unnecessary fees. Many of them are switching to Netflix or Amazon Prime Video subscriptions, but all those streaming services end up adding up to the same cost as cable! There are also other ways you can get cable channels without needing to pay a monthly fee. All your local news, weather, sitcoms, cooking shows, kid’s shows, sports and thousands of movies are available for free with the NovaWave. In fact, most broadcast stations offer additional regional programming, absolutely free.

The NovaWave simply attaches to your current TV’s antenna jack (all TV’s have them), and then you get to enjoy over 100+ channels completely free of charge. It supports 1080p HDTV and has a bunch of bonus features, so it’s nothing like the “rabbit ears” people used in the past. If you’re looking to get rid of cable TV once and for all, this could be the perfect solution for you and can save you a lot of money every month.

14. Automate Your Thermostat or Use A Post-It Note

In my first home, I would manually turn up the thermostat as I walked out the door to work, and I would manually adjust it down when I came home in the evening. Last year I replaced all of the thermostats in my house with the Nest learning thermostat. It learns your schedule to keep your home comfortable when you are home. Nests’ are pricey, but according to the Nest website, some energy companies will give you a $249 Nest Thermostat free when you sign up for some of their plans. Definitely check with your utility provider to see what you can get from them. If you can’t get a free or discounted smart thermostat from your utility provider, you can go the manual route like I used to. Go get a sticky note, and put it on the door you take to leave your home. Write a reminder to change the thermostat as you walk out the door. Simple and free.

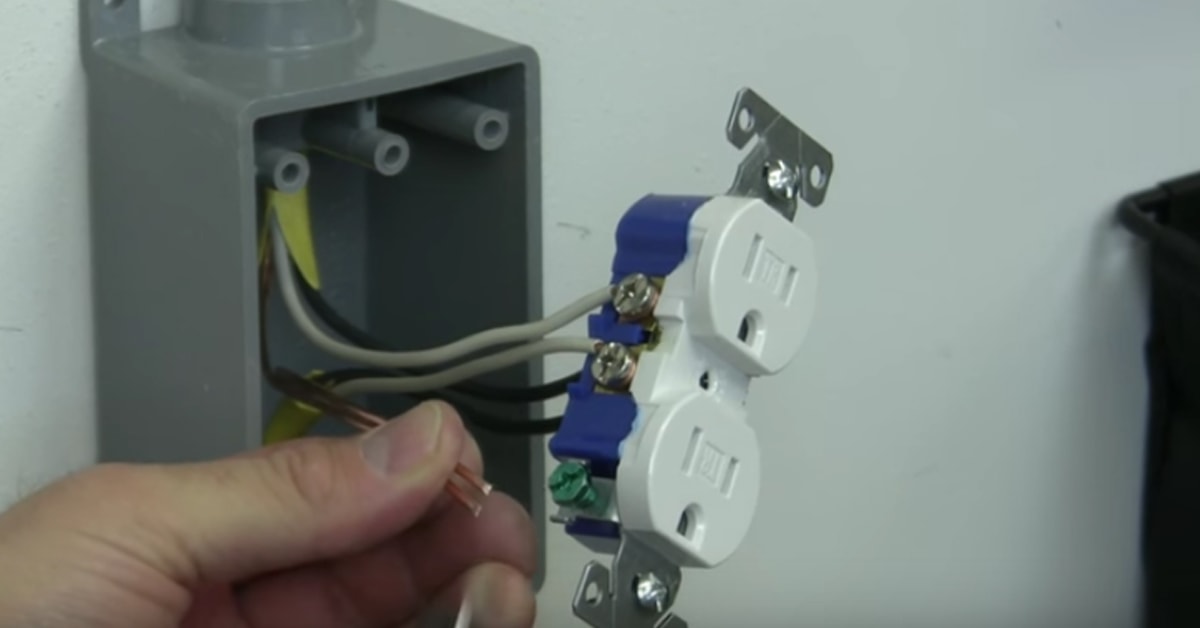

15. Child Proof Your Outlets – Even If You Don’t Have Kids

My first home which was built in 1999 had this next problem. The inside outlets located on the exterior walls were like mini vacuums when it came to transferring air from the inside to the outside.

If you have an older home or a poorly constructed home you’ve probably got the same problem.

Electrical outlet boxes typically don’t have any insulation behind them, creating what is basically a hole in your wall. On a windy day take some incense or a match and put it in front of an outlet (one without a plug in it of course) and see if you can see air movement. In my situation I noticed this during the winter when I felt a cold breeze coming through the outlets.

The simple solution? Install socket sealers to improve energy efficiency. All you have to do is remove your outlet cover with a screwdriver, put on the outlet sealer, and put the cover back on. Easy!

The second step is to put in those plastic child-proof outlet plugs.

16. Consolidate All Your Existing Debt Into One Simple Payment

Debt consolidation is the process of combining all your unsecured debts into a single monthly payment. Generally this allows for much lower payments on a monthly basis than the sum total of the separate debts – making life a lot more manageable. The likelihood in these circumstances of reducing interest rates is very high, and there are many firms out there who will walk you through the process making it simple and painless. If you have more than $20,000 in debt, then this is something you should do right away. You can get the best quote to consolidate all your unsecured debt by clicking the link below.

17. Insulate Leaky Kitchen and Bathroom Sinks

If you have a sink, toilet, cable or phone line in an external wall, chances are they are uninsulated around behind the wall. Warm and cool air is escaping from these exterior openings.

This one is a bit trickier to determine if you have an air leak. You can use a thermal leak detector to determine if there is a temperature difference by comparing the area near the hole and then the hole itself. If there is a big difference you might want to fix that leak.

Or if you don’t want to spend the money on thermal imaging you can do what I do as soon as I move into a new house. Buy some expanding foam insulation and spray it into every crevice I can find in my exterior walls.