Who doesn’t enjoy a big shopping trip? This can be your opportunity to buy a few things for the house, update your wardrobe or rack up from an end-of-the-season sale. For many, shopping is something they do a few times a year, and these people can often window shop and walk out the mall empty-handed.

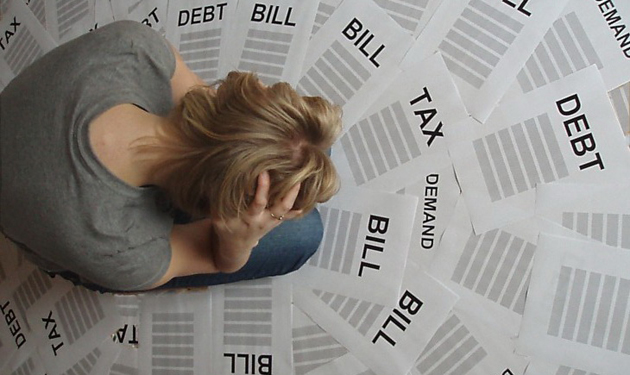

But for others, shopping is a real problem that takes over their lives. Shopaholics typically can’t go more than a couple of days without making a purchase, and they often spend money that they don’t have.

Does this sound familiar? Some people unknowingly fit the description of a shopaholic. Here are seven signs of a possible shopping addiction.

1. Plastic is your best friend.

Most people have at least one credit card in their wallet. These are useful in an emergency. But if your number of credit card swipes exceed your number of emergencies, or if you have at least one maxed out credit card, you may have a shopping problem. Granted, using your credit card for everyday purchases doesn’t necessarily indicate a problem. Maybe your credit card has a rewards program and you earn cash back or points on every purchase. In this case, regular credit card use can build your rewards faster and ultimately save you money. However, if your credit cards are simply a substitute for cash, and you don’t pay off your balances each month, it’s time to evaluate your spending habits.

2. No savings account.

I can’t stress the importance of a saving account. Yes, money might burn a hole in your pocket. But without a savings account, how could you survive a job loss, an illness or other emergency? Plus, with little or no savings, it’s easier to fall into a cycle of debt. Building a savings account is challenging when you have a shopping addiction. Even if you have the disposable income to deposit 5% or 10% of your pay into a personal savings account, you may waste this money on clothes, shoes and other items.

3. Frequent overdrafts on your bank account.

Everyone is likely to experience at least one bank overdraft in their life. This, however, doesn’t always indicate a shopping problem. A bank overdraft can also result from poor budgeting or forgetting to record a transaction. But if you’re experiencing bank overdrafts on a regular basis, there’s a bigger problem at hand. Some people with a shopping addiction lose their minds when they enter a retail store. If they see or touch something that they like, they have to have it. And oftentimes, they make purchases without checking their bank balances or waiting for bills to clear. This is a recipe for disaster, as some people with a shopping addiction spend more than they have available. This can send their bank balance into the red and trigger multiple overdraft fees.

4. Shopping makes you feel good and guilty.

How do you feel after a shopping trip? Happy? Guilty? Or both? Shopaholics typically experience mixed emotions. On one hand, walking into a mall and spending money can trigger an emotional high that lasts for several hours. Shopping may increase self-esteem, boost energy levels and produce a general feeling of optimism. Unfortunately, this feeling is often short-lived. And after shopping trips, many shopaholics feel guilty about their purchases or experience buyer’s remorse.

5. Buying clothes and other items in multiples.

Not sure if you’re a shopaholic? Open your closet door – the answer may lie inside. Buying in multiples is a classic sign of a shopping addiction – many shopaholics can’t just buy one of a particular item. If they find a tank top or a pair of shorts that fits them perfectly, they may buy one in every color. This can also apply to shoes and jackets. The obsession with buying multiples can overflow closets, and some shopaholics go as far as storing their clothes in other people’s closets.

6. Hiding purchases from loved ones.

Shopaholics love to deny a problem, yet they’re always quick to hide their purchases. Here’s the thing: If you don’t have a problem, then there’s really no reason to hide purchases. In most cases, you know that bringing a bag of new clothes into the house will spark an emotional response from your partner, parents or friends. And understandably, it’s easier to hide purchases than make waves with your loved ones. This approach may temporarily resolve tension, but it doesn’t get to the root of the problem.

7. Have items with price tags in your closet.

One or two price tags is your closet isn’t a big deal. But if you’ve never worn half the clothes in your closet, or worse, if you purchase clothes that aren’t even in your size, it’s time to get help. Shopaholics can’t deny themselves, and they often purchase more clothes than they can wear or need.